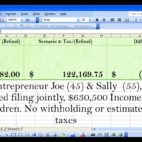

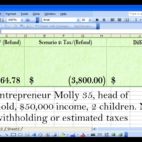

2018 TAX PLANNING SPREADSHEETS FOR ENTREPRENEURS

Now is the time to plan savings on your 2018 taxes!

This template works best with the FREE 2018 tax planning course.

2018 brought with it multiple tax changes: Some positive (e.g. double the standard deduction), and some negative (e.g. no more personal exemptions).

Without running the numbers for your particular situation, you might find out it’s too late to GET the ADVANTAGES that come with the tax reform.

With the 2018 tax planning template you can test to see how the reform affects your specific situation. You also get access to the free course which provides additional insights on your tax situation. You get this free course whether or not you get the template.

With this package you will be able to effectively plan to pay less in 2018!

In addition to planning your current situation, you can test what your tax liability will be as a sole proprietor, partnership, s corporation or c corporation. Since the tax rates for corporations have been lowered, it is worth taking a look to see if this is of benefit to you.

Bonuses

Along with the ability to estimate your taxes, you get these bonuses.

- Compliance Calendar: allows you to keep track of critical dates. Missing a filing requirement or deadline could impact your bottom line by making you pay late fees and penalties. You can also modify this file to add other important deadlines. Upload the file to google calendar and set the alerts you need.

- Paycheck calculator: estimate tax liability for your weekly, biweekly, semi monthly or monthly payroll

- Annual wage tax estimate: estimate W2 liability at year end

- Expense tracker for schedule c – track all your expenses for your schedule c.

- Invoicing –keep track of your invoices and print invoices for your clients

- Mileage Tracker – track your mileage

- Time card: time card for you or your employees

- Reimbursement – keep track of your business expenses you pay through your personal account and reimbursed by the business.

You can learn to make good tax decisions using this template. These additional templates if purchased separately are valued at $160 but you get them for free as part of this purchase.

Do not wait till 2018 to find out your tax liability, be sure to take advantage of the template and FREE COURSE to minimize your taxes.

Get the total 2018 tax planning package today for only $19.99. If you do not save at least your purchase price, your money will be returned.

This template works best with the FREE 2018 tax planning course.